It is common for people to presume that park homes would be insured under traditional buildings insurance, but this is not always the case. In this article, we dive into the details to give you a clear overview of everything.

How To Insure A Park Home

Park homes are commonly insured through specialist park home insurers such as Towergate and Park Home Assist. There are plenty of providers out there, so similarly to when you’re taking out other insurances such as, for your house or car, it’s advisable that you shop around to ensure you get the best terms of cover and price available. Compare The Market can be handy for speeding up this process, allowing you to compare prices of some of the main providers.

What Park Home Insurance Commonly Covers

Whilst the provision for park home insurance is separate to traditional building insurance, people will be familiar with the type of cover that the providers offer.

- Building Structure – Protection against damage from fire, flood, storms, and other perils.

- Contents – Coverage for your personal belongings, including furniture, electronics, and clothing.

- Third-Party Liability – Legal liability if you accidentally cause damage to someone else’s property or injure them.

- Accidental Damage – Coverage for accidental damage to your park home, such as broken windows or damaged fixtures.

Average Cost of Park Home Insurance

There are many different aspects that can affect the price of park home insurance, most of which should be considered before even buying one. On average, you can expect to pay between £200 and £400 a year, though this may increase or even decrease based on the following factors:

- Value of the Park Home – When applying for park home insurance, it’s essential to know the value of your park home. If it’s a new purchase, use the purchase price; for renewals, check the prices of similar for sale.

- Flood Risk – There will almost certainly be a question on if the park home is located in an area at risk of flooding. If you’re currently in the process of buying a park home, this is an important factor that should be considered. For instance, at Parklands of Lincoln, we are very low risk of flooding, which can offer you peace of mind and won’t be a concern when it comes to coverage for your park home here.

- Value of Contents – If you choose to have contents insurance as well, then it’s advisable to put together an inventory of your belongings. If you have high worth items that you would also like covered such as jewellery or art, you will need to ascertain their value first, and then add these to your policy.

Adding Accidental Damage Cover To Your Policy

Accidental damage cover offers protection against accidental damage done to your park home, such as broken windows or damaged fixtures. It can sometimes be difficult to gauge whether such options are worth the extra cost, and although we hope nothing accidental would happen, they’re accidents, and most of the time out of our control.

Ask yourself whether your accident prone and the likelihood of you needing to raise a claim in this regard. Weigh the risk against whether in such a situation you’d be financially able to manage such costs.

Conclusion: Should I Take Out Park Home Insurance?

We highly recommend you take out insurance for your park home. For the little extra it’ll cost you a year or month, however you decide to pay for it, you’ll be extremely thankful you’ve got it if anything goes wrong.

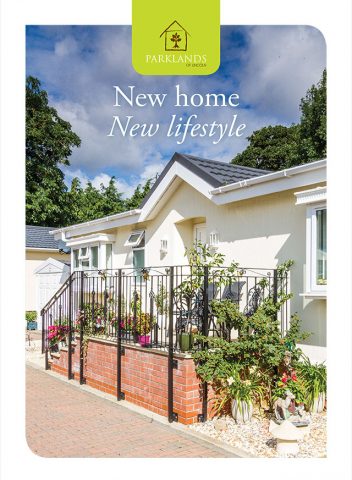

Interested in buying a park home in a peaceful, low risk setting? We urge you to come visit at Parklands – a retirement development located in Lincolnshire, not far from Lincoln. With everything you’ll need on your doorstep, it truly is the perfect retirement location. Explore the park home options available for sale on our site today.